BBO solutions from B2N

For European Exchanges - free real-time Level 1 data is available now from more than one exchange venue. For instance Chi-X streams real-time data on the 800 largest stocks in Europe delivered by your existing market data feeds from Bloomberg and Thomson Reuters. Cost centre owners will thank you for promoting the use of such free sources inside your firm!

What about those not in the list of 800 largest stocks?

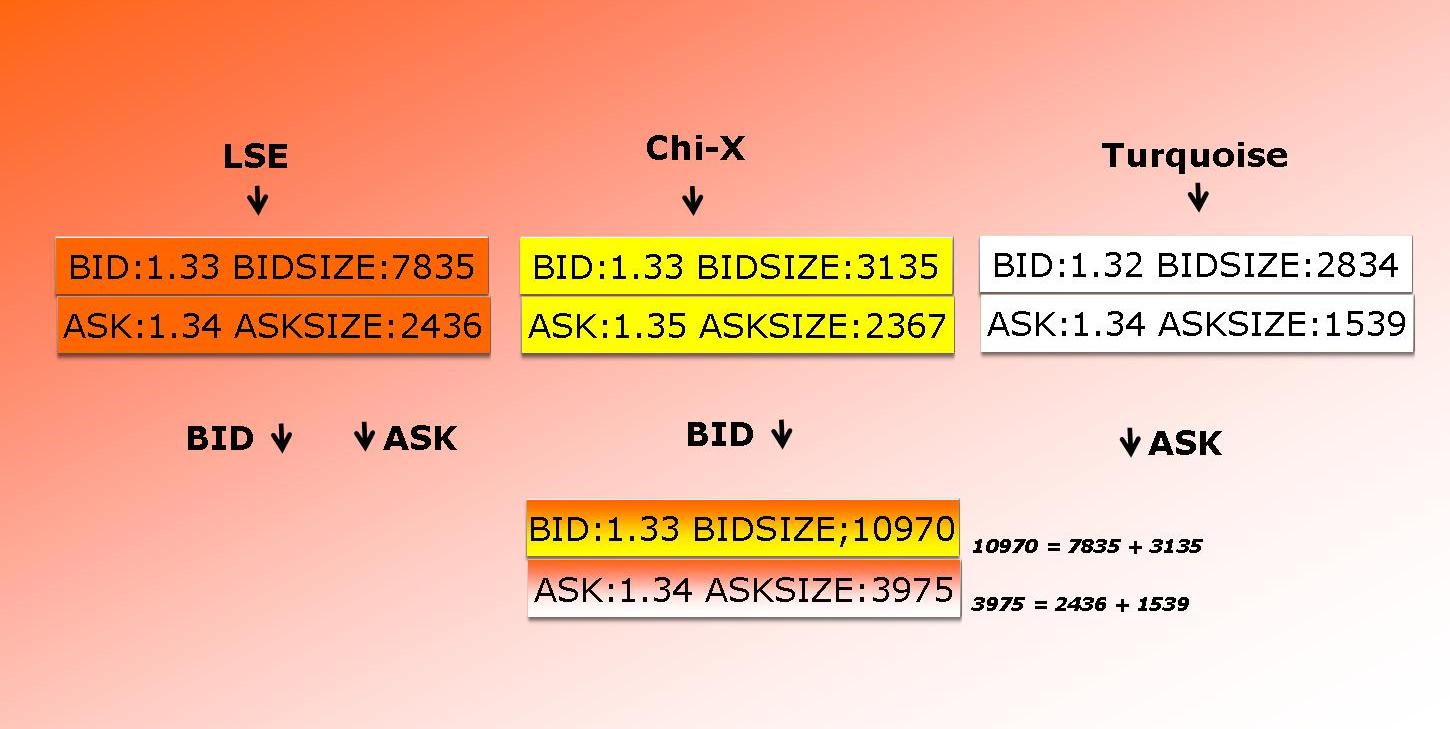

For this set of instruments we present B2N IntelliBBO (volume weighted Best Bid and Offer) which supplies BBO for the required volume. As a side effect the prices created by your configuration of IntelliBBO cannot be ‘calculated back’ to the original source, providing further efficiency opportunities.

Does this work for all people and all venues?

For the first category - those wishing to execute trades on fee-liable exchange venues all bids and offers from all venues will be required. Efficiencies for such people can be achieved by using B2N L2 Aggregator which provides a consolidated Order Book and derives the optimal locations for execution of a trade across multiple venues. In the second category there are many people for whom B2N IntelliBBO and/or B2N Order book data meets all their needs for prices. This can be true for sales people and those who use the data as a background to their primary activity in financial markets.

How does it work?

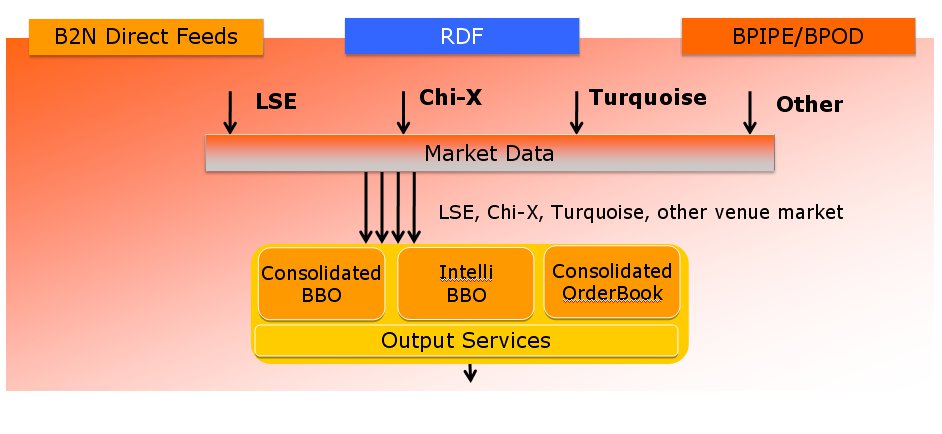

The technology solution is feed-based and will work under your control with your existing feeds.

Data delivered by Bloomberg and/or Thomson Reuters or other vendors can be used. Additionally, the solution is available for customers who do not have RMDS infrastructure, using the B2N MarketHub platform or other third party.

MarketHub

- MarketHub Messaging Infrastructure

- MarketHub Authority Server

- MarketHub Client Pack

- MarketHub Session and SecureSession API’s

- MarketHub Adapters to Third Party Platform ( e.g. RMDS)

- MarketHub Feed Handlers

- BBO solutions from B2N

- MarketHub Feed Control ( Data Refining Factory)

- MarketHub Data Deferring

- MarketHub Hi-Perf Excel Publisher

- MarketHub Historical Pack

- MarketHub Web Site Pack

- Full Product List